Accounting

EY Tops Rival Audit Firms in Public Company Clients

The Big Four firm audited 1,004 of the 6,950 public companies registered with the SEC in 2023, the most of any audit firm.

Jun. 20, 2023

EY audited 1,004 of the 6,950 public companies registered with the Securities and Exchange Commission between March 1, 2022, and May 14, 2023, the most of any audit firm, according to a new analysis by Audit Analytics.

Overall, 258 audit firms competed for those 6,950 public company clients—a 4.5% increase in population compared to 2022. This is the fourth consecutive year the number of SEC registrants has increased, Audit Analytics said.

EY, which audited 14.4% of all SEC-registered public companies in 2023, picked up 25 new clients over the last year. Of the top 10 audit firms in SEC registrant count, eight increased their client rosters in 2023.

The top 10 firms are the same as last year, even though some positions have changed, according to Audit Analytics. Grant Thornton, BDO USA, and BF Borgers moved up to sixth, seventh, and eighth place, respectively. Withum, which was sixth in 2022, dropped to ninth in 2023 with 177 audit clients, down from 296 last year. And even though BDO USA moved up one spot to seventh in 2023, the firm lost 15 audit clients over the past year.

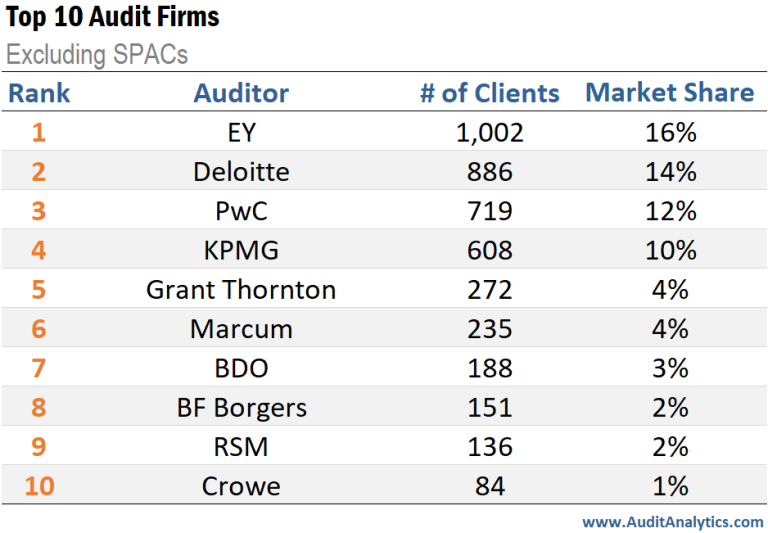

One thing that has influenced audit market share over the past few years is the emergence of special-purpose acquisition companies and shell companies, Audit Analytics said. As of May 14, there were 707 SPACs and shell companies registered with the SEC. After removing SPACs, the top 10 firms by registrant count changes.

Audit Analytics said:

While the Big Four figures remain relatively unchanged, the smaller firms shift slightly. Most notably, the shifts in rank for Grant Thornton and Marcum when excluding SPACs.

Marcum’s concentration on SPACs accounts for 55% of their SEC registrant clients. When these companies are excluded, Marcum’s rank falls to sixth and Grant Thornton moves into fifth. Additionally, Withum no longer makes the list of top firms while Crowe moves into tenth.

Collectively, these top ten firms audit 69% of the public company market excluding SPACs.

The Big Four firms dominated the market share of large-accelerated filers, auditing 88% of this market. EY remained in the lead for a seventh consecutive year with 600 clients, auditing 28% of all large-accelerated filers. Outside of the Big Four, there were 33 other firms that competed for the remaining 12% of the large-accelerated filer market. Since last year’s analysis, the population of large-accelerated filers decreased by 4%, according to Audit Analytics.

Deloitte is once again the top audit firm of both accelerated filers (19% of market share) and non-accelerated filers (20% of market share).

You can find out more results of the Audit Analytics analysis here.